Protect your business: find and prevent organizational fraud

your business

from fraud

and mitigate risk

unpleasant surprises

in your accounting

Less than the cost of

a corporate offsite

For many small businesses, losses from fraud can be crippling. Until now, this risk has been the cost of doing business. Manual investigations are very expensive and are only engaged reactively. Because of this, traditionally fraud could only be discovered by luck, or the kindness of a whistle-blower.

Founded by a team of retired Federal Agents and veteran technologists, Advanced Fraud Analytics has made it possible to easily uncover indicia or red flags of occupational fraud in your business. By scanning your books for fraud we help you understand and mitigate risk, and protect your bottom line.

Occupational fraud

costs

of business

revenue

nationwide.

Median loss

Average loss

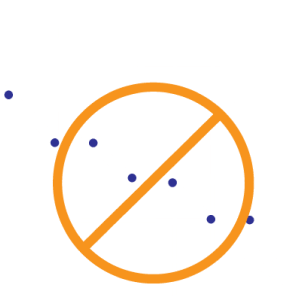

Our team helps you compile and upload your data.

We clean and scan your data.

We deliver you a report detailing any red flags, and your risk profile.

In an advisory session one of our Fraud Analysts will help interpret the report, and advise you on any required remediation or follow up investigation.

AFA was founded by a team of retired Federal Agents and veteran technologists. Our mission is to help companies manage risk, reduce loss and do business safely by discovering occupational fraud at an affordable cost.

Michael DeMeo is a retired federal law enforcement officer with 25 years of experience. Michael was a group leader in the Financial Crimes squad at the U.S. Secret Service and a senior agent assigned to the Protective Intelligence and Threat Assessment squad (PI). Michael is a Master Analyst in Financial Forensics, MAFF, and is a member of the National Association of Certified Valuators and Analysts, NACVA.

Matt Grossman is a technologist, strategist and entrepreneur. Matt has managed product, brand and user experience for a number of technology startups, from B2B products surrounding AI, litigation support, and access management to music technology and production. His focus is on the development and deployment of highly useable technical solutions that help businesses streamline operations and increase profitability.